north carolina real estate tax records

Box 38 Halifax NC 27839. Visit North Carolinas MyDMV website for more information.

201 North Chestnut Street Winston-Salem NC 27101 Assessor PO.

. The Real Property Records Search allows the user to obtain ownership information as of January 1. Payment drop box located at public North parking lot at courthouse. Real Estate Information - Tax Department - North Carolina.

This site provides read access to tax record information from Onslow County North Carolina. 230 Government Center Drive Suite 190. Public Property Records provide information on land homes and commercial properties.

The Address Owner and Subdivision searches. The average property tax rate in North Carolina is low compared to other states. A tax lien attaches to real estate on January 1 and remains in place until all taxes on the property are.

Anytime we make a change in your property value you will be notified in writing. A North Carolina Property Records Search locates real estate documents related to property in NC. Imposition of Excise Tax NCGS 105-22830 a An excise tax is levied on each instrument by which any interest in real property is.

On Wednesday October 19 2022 the Dare County Tax Department will undergo a software system upgrade. This is a tall silver box. The statewide average effective property tax rate is 077 lower than the national average.

Property 4 days ago Real Estate Information. The convenience fee for Electronic Check transactions is 275 for each payment less than or equal to 10000 and 15 for each payment greater than 10000. Wayne County Tax Collector PO.

There is no mortgage tax in North Carolina. We expect the online. Box 757 Winston-Salem NC 27102.

If you do not agree with this value you should contact our Information Center at 910 798-7300 and they. Durham County Tax Administration provides online Real Property Records Search. Historic Courthouse 10 North King Street Halifax NC 27839.

The Administrators Office is responsible for maintaining records of real and personal property ownership for use as a basis for ad valorem taxation. Tax Administrations online payment system will not be available due to network upgrades scheduled for Monday October 31st between 900 am. You can use this.

Payments Please send payments to. Starting March 1 2019 the Davidson County Tax Department will be implementing the Tax Certification requirements per North Carolina General Statute 161-31 and the resolution. This information is collected and used on.

Box 1495 Goldsboro NC 27533. Real estate in Wake County is permanently listed and does not require an annual listing. Property Tax The Local Government Division provides support and services to the counties and municipalities of North Carolina as well as taxpayers concerning taxes collected locally by the.

To access this information start by performing a search of the property records data by selecting. Searches from this page will produce Catawba County Real Estate reports. On this day access to personal property and billing records will temporarily.

Catawba County GIS Real Estate Reports.

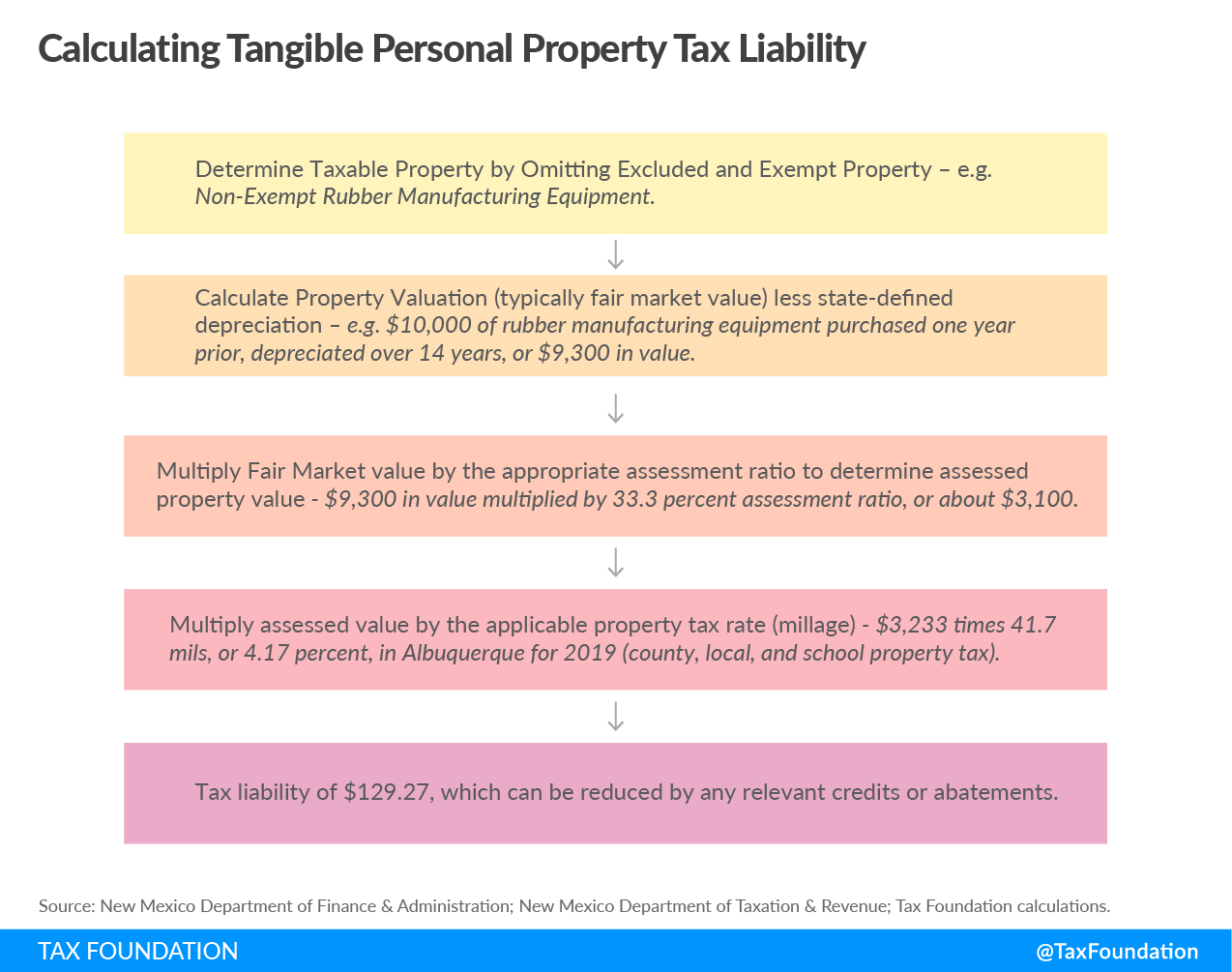

Tangible Personal Property State Tangible Personal Property Taxes

North Carolina Property Tax Law Monitor Bell Davis Pitt

Real Estate Wake County Government

Tax Department Home Henderson County North Carolina

Tax Collections Henderson County North Carolina

North Carolina Secretary Of State Land Records Land Records

Taking A Magnifying Glass To Property Tax Inequities

Understanding Your Property Tax Bill Davie County Nc Official Website

North Carolina Property Tax Calculator Smartasset

North Carolina Property Tax Records

Chatham County Tax Record Application Search